Latest housing need figures

The debate over whether we need any more houses can be highly emotive between appellants and objectors. On this issue it can help to refer to the latest statistics published by the Government on 28th March 2019 on the relative affordability of housing over time.

Affordability ratios

The Government measure of affordability takes average house prices and divides by average incomes to produce a ratio known as the “affordability ratio”. More accurately, the affordability ratio is calculated by taking the median house price and dividing by the median workplace-based income to provide a simple ratio.

For England and Wales as a whole, this ratio increased from 4.13 in the year 2000 to 7.83 in 2018. In other words, in 2000 the average houseprice was 4.13 times the average income, whereas in 2018 it was 7.83 times average incomes.

The affordability ratio is available for every local planning authority and in 2018 ranged from 44.51 times average incomes in Kensington and Chelsea, London down to 2.50 times average incomes in Copeland, NW England.

Change over time

The latest figures, published 28th March 2019, provide house prices and incomes for every local planning authority for every year from 1997 to 2018. They reveal that 58% of local planning authorities experienced a decrease in affordability in the past 12 months. The data for your local planning authority can be found here. The relevant table in the spreadsheet is table 5c Ratio of Median House Prices to workplace-based earnings, by local authority.

Challenging five year housing land supply figures

Affordability ratios are important when calculatihereng whether a local planning authority has enough housing land coming through its planning process. If a local planning authority cannot demonstrate that it has five years' supply of housing land available for development, it is much harder for that Council to resist development.

If a Local Plan is over five years' old, then the five year housing land supply figure must be calculated following the Government's standard methodology on assessing housing need, contained in the National Planning Practice Guidance here.

How much housing is needed?

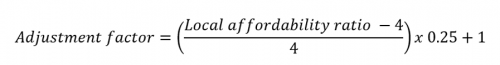

The amount of housing needed is the projected increase in the number of households over the next 10 years, expressed as an average per annum, multiplied by an adjustment factor based on the affordability ratio. The adjustment is calculated as follows:

For example, Manchester's affordability ratio for 2018 was 5.74. To start the calculation, deduct 4 then apply the rest of the equation. Manchester's adjustment factor is therefore [(1.74/4)x0.25]+1 = 1.109. Its housing need based on demographic projections is multiplied by 1.109 (ie. increased by 10.9%) to adjust for the affordability of housing in Manchester.

Change in the affordability ratio has an impact on the amount of housing needed. For example, in 2014 Manchester's housing affordability ratio was 4.77 and its adjustment figure would have been 1.048 (ie. increase by 4.8%).

From the above example it can be seen that change in the affordability ratio over time has an immediate impact on the amount of housing needed, and the calculation of whether a local planning authority can demonstrate a five year supply of housing land against its housing need figure.

Tackling housing need

The annual publication of housing affordability ratios for every local planning authority in the country should make it easier to track whether housing needs are getting better or worse in your area.

To find appeals that are relevant to you, use the search on our Home page.