Do rising house prices help win an planning appeal

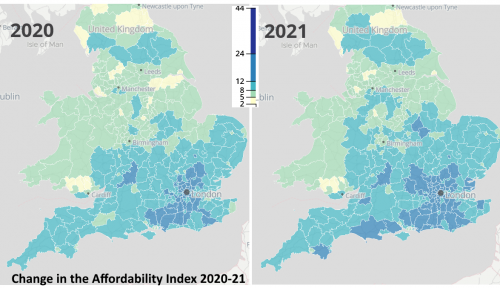

House prices are rising fast and today’s release from the Government on housing affordability shows growing problems for an increasing number of local authorities.

Is this a material consideration in an appeal?

Inspectors often reason a few houses here and there will make little difference to the overall picture, so is it worth even mentioning house prices in an appeal for a minor residential development? It all depends on how you refer to it.

Referring to the missed national target of 300,000 new homes per year is pretty ineffective. Housing evidence has to be at the right geographic scale, which means as local as you can get. It also has to be approached with an understanding of how the evidence you provide might be used by the Inspector.

In a small number of local planning authorities, the latest statistics will tip the balance on their five year housing supply (5YS), or mean that they fail next year's housing delivery test. For these LPAs the worsening affordability of housing is dynamite.

For the majority of LPAs however, those with either a 5YS or a Local Plan adopted within the last five years, housing need is rarely a “main issue” in an appeal for a minor development. The Local Plan is assumed to reflect housing need in its policies. Usually an Inspector can reasonably rely on the fact the Local Plan considered housing needs, unless you can provide up-to-date statistics which demonstrate a change since the Local Plan was adopted. Fortunately obtaining such statistics is now very easy if you know where to look (weblinks below).

There are too many appeal Decisions where the Inspector dismisses the appeal citing they, “have not been presented with any evidence that the development would address any identified local housing needs”. Inspectors like evidence. It’s concrete, it’s definitive, and they can quote it in their Decision. If they allow an appeal, they have to provide reasons for coming to a different decision from the local planning authority. Giving the Inspector authoritative evidence gives them the option of finding housing needs have changed and/or should be given greater weight.

There is also a need to get the language right in order to press the right buttons. Google translate doesn’t convert ‘normal conversation’ into ‘planning speak’ so here is my rough translation: everyday language of “people just need somewhere to live” becomes, “there is evidence of local housing need”. “There’s a problem with high house prices” becomes “evidence of local affordability problems”.

The right measure of ‘local affordability’ is table 5c in the annual statistics on house prices to workplace-based earnings ratio published by the Office of National Statistics in March every year down to local planning authority level. For example, if median house prices were £300,000 and median earnings were £30,000p.a, then average house prices are 10 times average local incomes and the affordability ratio would be 10. This measure is considered a more reasonable reflection of affordability than house prices on their own. The average affordability ratio for England in September 2021 was 9.1, having jumped from an average ratio of 7.9 in 2020 (the latest ONS figures published 23rd March 2022 use September 2021 data).

Impact on official housing needs

The affordability ratio is a key component of the Government’s “standard method” for calculating housing need. The standard method uses the affordability ratio to adjust housing need upwards. For example:

|

Affordability Ratio |

Adjustment to housing needs |

| 8 | +25% |

| 10 | +37.5% |

| 12 | +50% |

An affordability ratio of 8 results in a LPA’s housing need being adjusted upwards by 25% while an affordability ratio of 12 results in an increase of 50%. For most appeals there is no need to delve into the complexities of the LPA’s housing need calculation. It is sufficient to simply show the direction of travel of the affordability ratio in order to make the point the situation has worsened since the Local Plan was prepared.

In the past year, 21 local planning authorities have seen increases of over 2 points in their affordability ratio, equating to an increase in over 12.5% in their housing need calculation. The worst have been Melton (affordability ratio up from 8.87 to 12.27), West Devon (up from 8.70 to 11.96) and Sutton (up from 11.11 to 14.24). In fact 91% of all local planning authorities have seen their affordability ratio increase according to the 2022 ONS assessment.

Drawing attention to local housing needs in an appeal

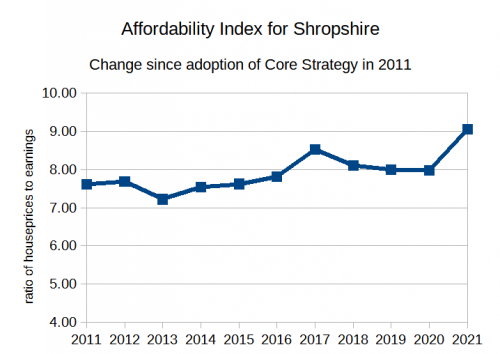

To demonstrate to an appeal Inspector that housing needs have worsened and should therefore be taken into account as a material consideration in an appeal, it can be helpful to convert the figures into a graph like the one below, to illustrate how the situation has changed since the Local Development Plan was adopted:

Providing hard evidence of worsening local affordability helps highlight the public benefits of residential development. It ties in with NPPF para 8b which seeks development, “to support strong, vibrant and healthy communities by ensuring that a sufficient number and range of homes can be provided to meet the needs of present and future generations”. Drawing attention to evidence the local area is struggling to achieve this ambition can increase the weight the Inspector gives to housing provision in weighing up the benefits against harms.

To conclude, evidence of housing need statistics won’t on its own win an appeal, but it definitely contributes to tipping the scales. The affordability ratio provides a Planning Inspector with hard facts to consider which may help to justify overturning the LPA’s decision. Appellants have nothing to lose by a quick reference to the latest evidence.

To find appeals that are relevant to you see our Home page.